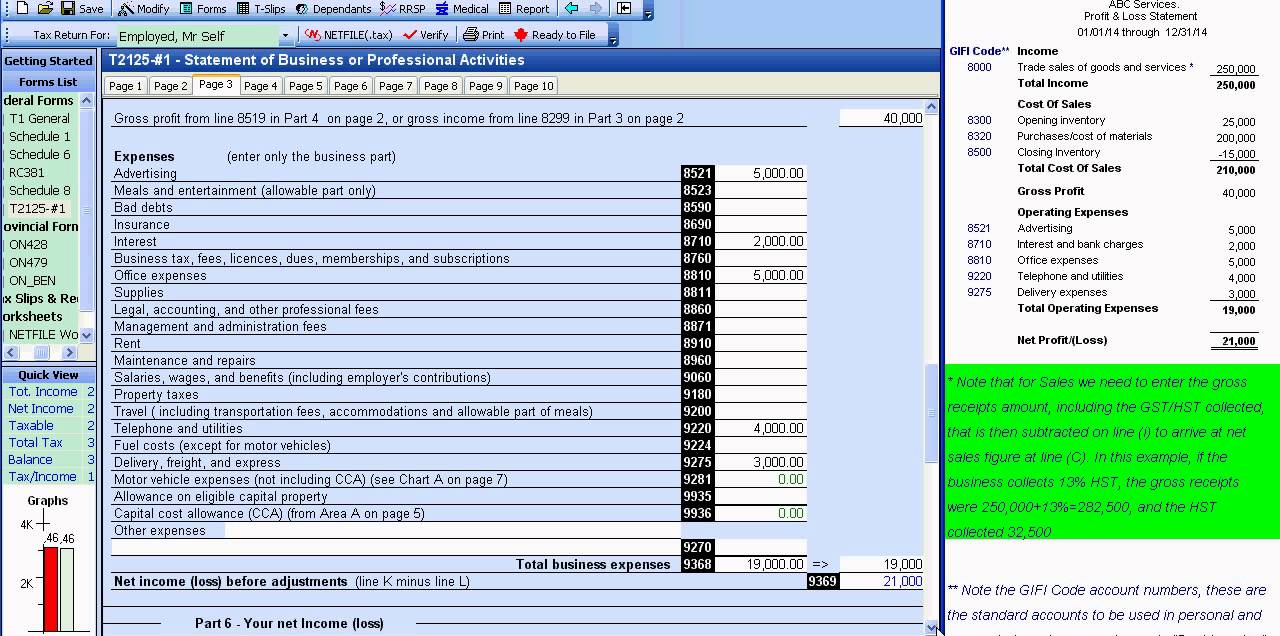

Canadian Tax Forms For Self Employed . You'll need to include things like your source (s) of business income, any gst. Web use the t2125 form to report either business or professional income and expenses. Web 7 rows the t2125 form is available online via the canada revenue agency (cra) website. This helps calculate your gross income. Web complete the t2125 form: Learn about forms t1, t2125, t4a, and gst34, & how and when to file them. This form combines the two previous forms, t2124,.

from www.youtube.com

Web complete the t2125 form: Web 7 rows the t2125 form is available online via the canada revenue agency (cra) website. This helps calculate your gross income. Learn about forms t1, t2125, t4a, and gst34, & how and when to file them. Web use the t2125 form to report either business or professional income and expenses. You'll need to include things like your source (s) of business income, any gst. This form combines the two previous forms, t2124,.

How to do SelfEmployed Tax Return in Canada YouTube

Canadian Tax Forms For Self Employed Web use the t2125 form to report either business or professional income and expenses. Web 7 rows the t2125 form is available online via the canada revenue agency (cra) website. Learn about forms t1, t2125, t4a, and gst34, & how and when to file them. Web use the t2125 form to report either business or professional income and expenses. This helps calculate your gross income. Web complete the t2125 form: This form combines the two previous forms, t2124,. You'll need to include things like your source (s) of business income, any gst.

From www.keepertax.com

How to File SelfEmployment Taxes, Step by Step Your Guide Canadian Tax Forms For Self Employed This helps calculate your gross income. Web 7 rows the t2125 form is available online via the canada revenue agency (cra) website. Web complete the t2125 form: You'll need to include things like your source (s) of business income, any gst. This form combines the two previous forms, t2124,. Web use the t2125 form to report either business or professional. Canadian Tax Forms For Self Employed.

From www.employementform.com

2005 Self Employment Tax Form Employment Form Canadian Tax Forms For Self Employed This helps calculate your gross income. Web use the t2125 form to report either business or professional income and expenses. Web 7 rows the t2125 form is available online via the canada revenue agency (cra) website. You'll need to include things like your source (s) of business income, any gst. Learn about forms t1, t2125, t4a, and gst34, & how. Canadian Tax Forms For Self Employed.

From www.pinterest.com

Tax Forms, Self Employment, Quickbooks Canadian Tax Forms For Self Employed Web complete the t2125 form: Learn about forms t1, t2125, t4a, and gst34, & how and when to file them. You'll need to include things like your source (s) of business income, any gst. Web 7 rows the t2125 form is available online via the canada revenue agency (cra) website. This form combines the two previous forms, t2124,. Web use. Canadian Tax Forms For Self Employed.

From learningschooljfreyre8d.z22.web.core.windows.net

Self Employed Calculation Worksheet Canadian Tax Forms For Self Employed You'll need to include things like your source (s) of business income, any gst. This helps calculate your gross income. This form combines the two previous forms, t2124,. Learn about forms t1, t2125, t4a, and gst34, & how and when to file them. Web 7 rows the t2125 form is available online via the canada revenue agency (cra) website. Web. Canadian Tax Forms For Self Employed.

From www.employementform.com

Tax Form Self Employed Employment Form Canadian Tax Forms For Self Employed Web complete the t2125 form: Learn about forms t1, t2125, t4a, and gst34, & how and when to file them. Web 7 rows the t2125 form is available online via the canada revenue agency (cra) website. This helps calculate your gross income. You'll need to include things like your source (s) of business income, any gst. This form combines the. Canadian Tax Forms For Self Employed.

From cexozfej.blob.core.windows.net

Employee Tax File Form at Frank Torkelson blog Canadian Tax Forms For Self Employed Learn about forms t1, t2125, t4a, and gst34, & how and when to file them. This helps calculate your gross income. This form combines the two previous forms, t2124,. Web use the t2125 form to report either business or professional income and expenses. Web complete the t2125 form: You'll need to include things like your source (s) of business income,. Canadian Tax Forms For Self Employed.

From www.employementform.com

What Tax Form Does A Self Employed Person File Employment Form Canadian Tax Forms For Self Employed Web use the t2125 form to report either business or professional income and expenses. This helps calculate your gross income. This form combines the two previous forms, t2124,. Web complete the t2125 form: Web 7 rows the t2125 form is available online via the canada revenue agency (cra) website. Learn about forms t1, t2125, t4a, and gst34, & how and. Canadian Tax Forms For Self Employed.

From bankruptcytrusteebc.ca

Self Employed Taxes In Canada Help With Filing Your Tax And Canadian Tax Forms For Self Employed Learn about forms t1, t2125, t4a, and gst34, & how and when to file them. Web complete the t2125 form: Web use the t2125 form to report either business or professional income and expenses. This helps calculate your gross income. This form combines the two previous forms, t2124,. You'll need to include things like your source (s) of business income,. Canadian Tax Forms For Self Employed.

From elliebhortensia.pages.dev

Tax Calculator 2024 Canada Self Employed Mil Lorine Canadian Tax Forms For Self Employed Web 7 rows the t2125 form is available online via the canada revenue agency (cra) website. Web complete the t2125 form: You'll need to include things like your source (s) of business income, any gst. Web use the t2125 form to report either business or professional income and expenses. Learn about forms t1, t2125, t4a, and gst34, & how and. Canadian Tax Forms For Self Employed.

From www.employementform.com

Tax Forms For Self Employed Canada Employment Form Canadian Tax Forms For Self Employed Web complete the t2125 form: This helps calculate your gross income. Web use the t2125 form to report either business or professional income and expenses. You'll need to include things like your source (s) of business income, any gst. This form combines the two previous forms, t2124,. Web 7 rows the t2125 form is available online via the canada revenue. Canadian Tax Forms For Self Employed.

From db-excel.com

2016 Self Employment Tax And Deduction Worksheet — Canadian Tax Forms For Self Employed Web 7 rows the t2125 form is available online via the canada revenue agency (cra) website. Web use the t2125 form to report either business or professional income and expenses. This helps calculate your gross income. Web complete the t2125 form: This form combines the two previous forms, t2124,. Learn about forms t1, t2125, t4a, and gst34, & how and. Canadian Tax Forms For Self Employed.

From www.worksheeto.com

12 Best Images of Canadian Money Printable Worksheets 2nd Grade Math Canadian Tax Forms For Self Employed Web use the t2125 form to report either business or professional income and expenses. Web 7 rows the t2125 form is available online via the canada revenue agency (cra) website. Web complete the t2125 form: You'll need to include things like your source (s) of business income, any gst. This helps calculate your gross income. This form combines the two. Canadian Tax Forms For Self Employed.

From fr.wanakicenter.com

Tax Filing for SelfEmployed and Freelancers TurboTax® Canada Canadian Tax Forms For Self Employed This form combines the two previous forms, t2124,. This helps calculate your gross income. Web use the t2125 form to report either business or professional income and expenses. Learn about forms t1, t2125, t4a, and gst34, & how and when to file them. You'll need to include things like your source (s) of business income, any gst. Web complete the. Canadian Tax Forms For Self Employed.

From optimataxrelief.com

Tax Forms for SelfEmployed Individuals Canadian Tax Forms For Self Employed You'll need to include things like your source (s) of business income, any gst. Web complete the t2125 form: This form combines the two previous forms, t2124,. Web use the t2125 form to report either business or professional income and expenses. This helps calculate your gross income. Learn about forms t1, t2125, t4a, and gst34, & how and when to. Canadian Tax Forms For Self Employed.

From iantheqshoshanna.pages.dev

Tax Calculator 2024 Self Employed Joete Madelin Canadian Tax Forms For Self Employed You'll need to include things like your source (s) of business income, any gst. This form combines the two previous forms, t2124,. Learn about forms t1, t2125, t4a, and gst34, & how and when to file them. Web use the t2125 form to report either business or professional income and expenses. Web complete the t2125 form: This helps calculate your. Canadian Tax Forms For Self Employed.

From www.etsy.com

Editable Self Employed Pay Stub Template Etsy Canada Canadian Tax Forms For Self Employed This helps calculate your gross income. Web complete the t2125 form: You'll need to include things like your source (s) of business income, any gst. Learn about forms t1, t2125, t4a, and gst34, & how and when to file them. This form combines the two previous forms, t2124,. Web 7 rows the t2125 form is available online via the canada. Canadian Tax Forms For Self Employed.

From printablebotelhavigw.z4.web.core.windows.net

Self Employment Printable Small Business Tax Deductions Work Canadian Tax Forms For Self Employed Web 7 rows the t2125 form is available online via the canada revenue agency (cra) website. You'll need to include things like your source (s) of business income, any gst. Web complete the t2125 form: Web use the t2125 form to report either business or professional income and expenses. Learn about forms t1, t2125, t4a, and gst34, & how and. Canadian Tax Forms For Self Employed.

From www.employementform.com

Nyc Tax Form Self Employment Employment Form Canadian Tax Forms For Self Employed You'll need to include things like your source (s) of business income, any gst. Web 7 rows the t2125 form is available online via the canada revenue agency (cra) website. Web complete the t2125 form: Learn about forms t1, t2125, t4a, and gst34, & how and when to file them. This form combines the two previous forms, t2124,. This helps. Canadian Tax Forms For Self Employed.